Brighter Future Advisor Plan Portfolios

The Brighter Future Advisor Plan is a flexible, tax-advantaged, low-cost way to save for education.

For illustrative purposes only

7 Year-of-Enrollment Portfolios

Simply select the portfolio whose year of enrollment most closely corresponds to the year the Beneficiary plans to begin college. Then, in the years to come, that portfolio will gradually (and automatically) shift its asset allocation from a more aggressive and earnings-oriented mix of investments to a more conservative and preservation-oriented mix of investments. If you and your client are looking for a dynamic and managed approach to college savings, this is a smart way to go.

For illustrative purposes only

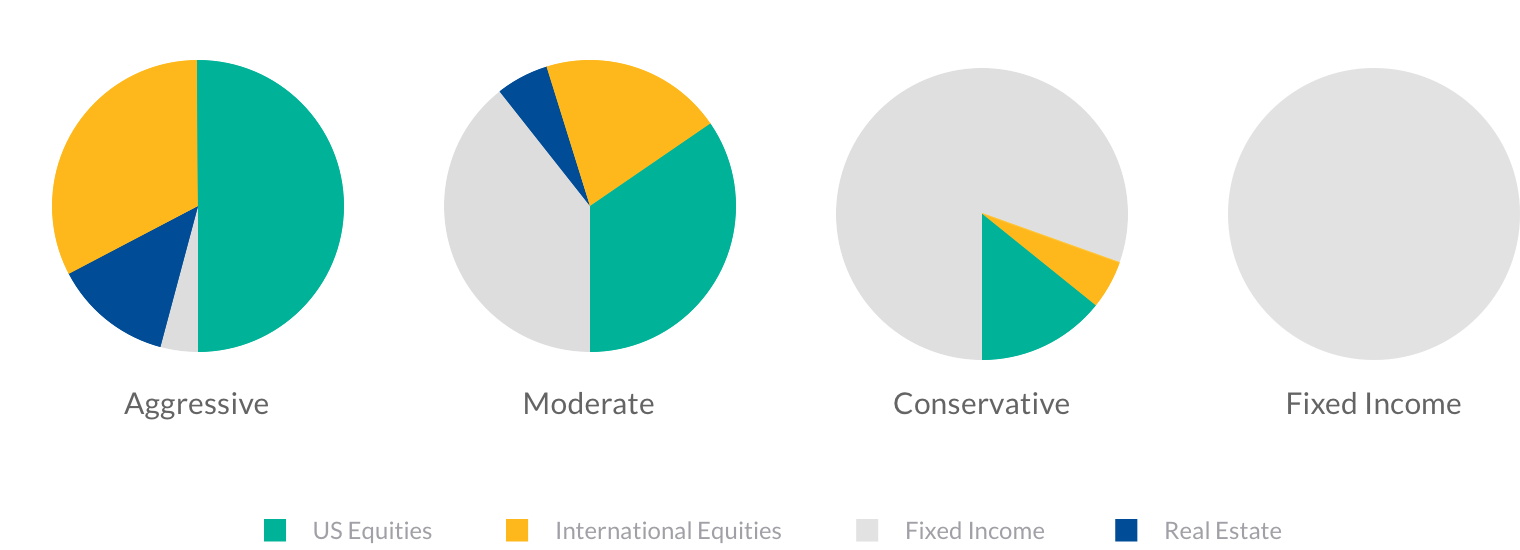

4 Asset Allocation Portfolios

These static portfolios are engineered to match a specific risk profile that you identify for your clients. The investment allocation of these portfolios will remain generally fixed over time. You control when - or even if - your client's assets switch to a different asset allocation.

17 Custom ETF Portfolios

If you'd rather roll up your sleeves and build your client a customized college savings portfolio using individual portfolios, the Brighter Future Advisor Plan can make it happen. Choose among domestic or international equity, real estate, or fixed income portfolios to create your customized portfolio. These portfolios invest in the same funds as iShares Asset Allocation and Year-of-Enrollment Portfolios.

U.S. Equities

iShares Core High Dividend Portfolio

iShares Core S&P Total U.S. Stock Market Portfolio

iShares Russell 1000 Portfolio

iShares Russell 2000 Portfolio

International Equities

iShares Core MSCI Total International Stock Portfolio

iShares Edge MSCI Min Vol EAFE Portfolio

iShares Core MSCI EAFE Portfolio

iShares Edge Min Vol Emerging Markets Portfolio

iShares Core MSCI Emerging Markets Portfolio

Real Estate

iShares Core U.S. REIT Portfolio

Fixed Income

iShares 20+ Year Treasury Bond Portfolio

iShares Core U.S. Aggregate Bond Portfolio

iShares 1-5 Year Investment Grade Corporate Bond Portfolio Class

iShares Short Treasury Bond Portfolio

iShares TIPS Bond Portfolio

iShares iBoxx $ High Yield Corporate Bond Portfolio

iShares iBoxx $ Investment Grade Corporate Bond Portfolio

1 Savings Portfolio

The FDIC-Insured Savings Portfolio option is available for investors who are interested in the preservation of principal. The Savings Portfolio, managed by Sallie Mae Bank, seeks to provide income consistent with the preservation of principal and invests 100% of its assets in the Sallie Mae High-Yield Savings Account (HYSA).1

The Savings Portfolio invests all of its assets in the Sallie Mae High-Yield Savings Account (HYSA). The HYSA is held in an omnibus savings account insured by the Federal Deposit Insurance Corporation (FDIC). Contributions to and earnings on the investments in the Savings Portfolio are insured by the FDIC on a pass-through basis to each Account Owner up to $250,000, the maximum amount set by federal law.

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the federal government to preserve and promote public confidence in the U.S. financial system by insuring deposits in banks and thrift institutions a pre-determined maximum set by law; by identifying, monitoring, and addressing risks to the deposit insurance funds; and by limiting the effect on the economy and the financial system when a bank or thrift institution fails.

Except for the Savings Portfolio, investments in the Brighter Future Advisor Plan are not insured by the FDIC. Contributions to and earnings on the investments in the Savings Portfolio are insured by the FDIC on a pass-through basis to each Account Owner up to $250,000, the maximum amount set by federal law. The amount of FDIC insurance provided to an Account Owner is based on the total of (a) the value of an Account Owner's investment in the Savings Portfolio; and (b) the value of all other accounts held by the Account Owner at Sallie Mae Bank, as determined by Sallie Mae Bank and FDIC regulations.

Contributions to and earnings on the investments in the Savings Portfolio are insured by the FDIC on a pass-through basis to each Account Owner up to $250,000, the maximum amount set by federal law. The amount of FDIC insurance provided to an Account Owner is based on the total of (a) the value of an Account Owner's investment in the Savings Portfolio; and (b) the value of all other accounts held by the Account Owner at Sallie Mae Bank, as determined by Sallie Mae Bank and FDIC regulations.

No. Investments in the Savings Portfolio will earn a varying rate of interest. Click here for historical returns.

1The HYSA is held in an omnibus savings account insured by the FDIC, which is held in trust by The Arkansas Section 529 Plan Review Committee ("Committee") at Sallie Mae Bank. Contributions to and earnings on the investments in the Savings Portfolio are insured by the FDIC on a pass-through basis to each account owner up, to the maximum amount set by federal law. The amount of FDIC insurance provided to the account owner is based on the total of (a) the value of an account owner's investment in the Savings Portfolio, and (b) the value of all other accounts held by the account owner at Sallie Mae Bank, as determined by Sallie Mae Bank and FDIC regulations. To the extent that FDIC insurance applies, the Savings Portfolio is primarily subject to income risk. The return of the underlying FDIC-insured HYSA will vary from week to week because of changing interest rates and the return of the HYSA will decline because of falling interest rates.